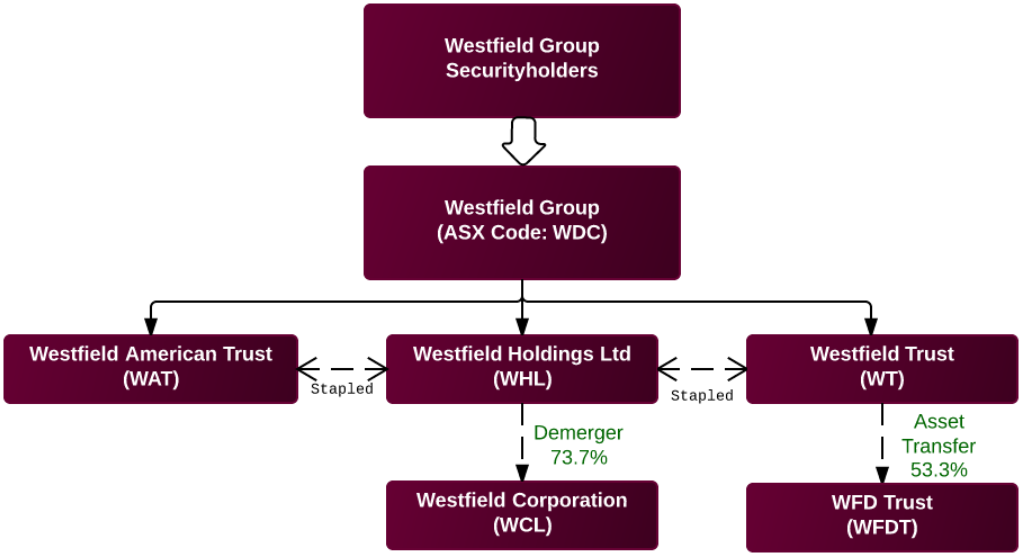

Stapled securities structures involving trusts have evolved.Most overseas markets do not have specific legislation to regulate business trusts, except Singapore. Business enterprises can be set up as a trust instead of a company.Competency frameworks for financial literacy.“What they are looking to do is get some flexibility for the acquisition of passive property assets. Lend Lease managed GPT for almost 30 years before splitting in 2005 after a proposed combination of the entities failed.īut O’Farrell said “there is no suggestion as I am seeing from Lend Lease that they want to take over any trust. The stapled securities structure has prompted some in the market to ask whether it might be preparing for a tilt for GPT, or Mirvac. Merrill Lynch said recently that given Lend Lease’s balance sheet capacity, investors could expect some acquisitions. Lend Lease has $1 billion in cash for future acquisitions. A stapled security will also allow for the tax-efficient absorption of other trusts. A company looking to take over a stapled entity can get capital gains tax relief in relation to the share component of the entity. Stapled securities can also encourage foreign investment, as certain offshore investors are only liable to pay 7.5 per cent withholding tax and pay no capital gains tax. The trust will receive flow-through tax treatment, where it will not be taxed but end investors will be. Purchasing them in a trust will allow Lend Lease to enhance its yield. The trading business can run as a company, while the trust can hold passive investments.Īround 20 per cent of Lend Lease’s earnings before interest, tax, depreciation and amortisation (EBITDA) each year comes from passive property assets. The stapling of securities involves separating two legal entities, such as a trust and a company, but trading them together on the ASX, which can have tax advantages. Mr O’Farrell said that the Australian Securities and Investments Commission had been “helpful but also very diligent" in assessing the application to allow the securities to trade. The Astro deal followed its separation from Babcock & Brown earlier this year. “The fundamentals around them - and stapling - look as though they will continue," he said.įreehills advised Lend Lease and Astro on their stapled structures. The tax office is also reviewing the treatment of managed investment trusts, which will likely involve a streamlining of rules.īut Freehills partner Justin O’Farrell said the tax office review was “not likely to result in a fundamental change to managed investment trusts." Around 50 stapled securities trade on the ASX, including Stockland, Australand, Westfield, Dexus and Abacus.Īnalysts say that given the move to simplicity in the wake of recent corporate collapses, some stapled entities are looking to de-staple, which would also save on administration costs. It follows Astro Japan Property Trust, which began trading as a stapled security last week. Lend Lease will become the latest stapled security on the Australian Securities Exchange when it begins trading on Friday, in a move that increases the acquisitive flexibility of the group.

0 kommentar(er)

0 kommentar(er)